Interest is allowed on most judgments entered in federal courts from the date of judgment, until paid. Generally, one of three statutes applies to judgments:

- 28 U.S.C. § 1961, which governs civil and bankruptcy adversary judgment interest;

- 18 U.S.C. § 3612 (f)(2), which governs criminal judgments or sentences; and

- 40 U.S.C. § 3116, which governs deficiency judgments in condemnation proceedings.

The specific interest rate to which the statutes refer is found in the tables (linked below), under the two columns titled "Week Ending". The two dates under those columns refer to the Friday averages of the last two weeks.

If the judgment date is the same as the release date -- the prior week’s release should be used. Releases are considered to be issued at the close of business on the date of release.

- Current week interest rate data (updated each Monday) may be found at:

http://www.federalreserve.gov/releases/h15/current/

NOTE: Search for "U.S. government securities" >> "Treasury constant maturities" >> "Nominal 9" >> "1-year".

- Historical interest rate data (updated each Monday) from January 5, 1962 to present may be found at:

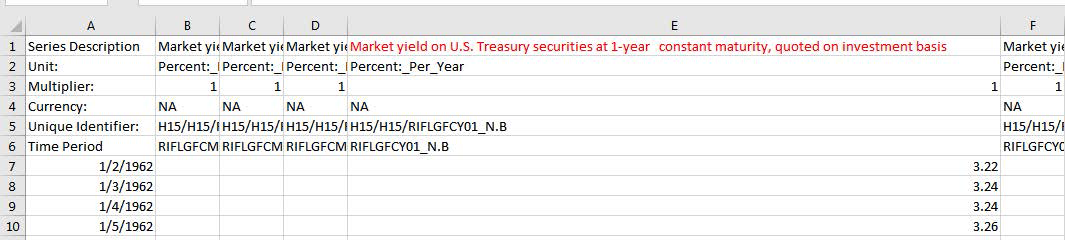

Historical Interest Rate Data Spreadsheet

NOTE: This link will open a spreadsheet with weekly interest rates. Within the spreadsheet, go to to the column titled, "Market yield on U.S. Treasury securities at 1-year constant maturity, quoted on investment basis" as depicted in the image below.

- For questions regarding interest rates, please contact the Financial Services Office, at (317) 229-3912.